Contents:

Upon completion of the examination, a pass/fail message will appear on your computer screen. Test scores are confidential and will be revealed only to you and the IRS. In addition, you will receive an email from Prometric containing your score report.

It is a highly respected accounting certification that has the power to boost careers and expand opportunities within the profession. Yes, there is a shortage of enrolled agents that can handle complicated tax returns and have the ability to represent clients before the IRS. If you want to go into a growing career and offer plenty of options, this could be the right one.

The length of time required to become an enrolled agent is much less than the amount of time required to become a CPA. In terms of cities, the nation’s largest metro areas rank among the employment leaders for tax preparers. Note the strong labor market demand in the Washington, D.C., area, which has a very high concentration of federal government agencies. Local labor market conditions can also play a role in setting tax preparer incomes.

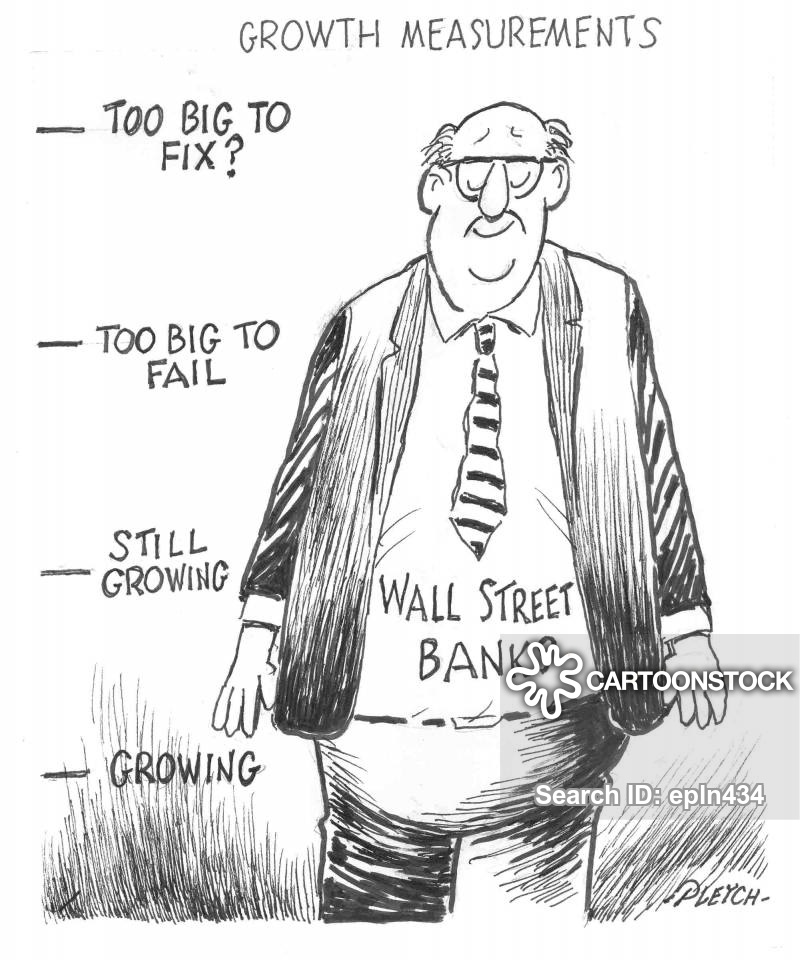

Large firms are willing and able to pay a premium to attract top talent. The larger the company, the higher the pay for a given role, and the better defined your career path will be. Office managers oversee several ongoing projects at once and work with staff to ensure that operations run smoothly. They must stay up to date on a wide variety of projects and report directly to higher-level executives. Especially in organizations that employ many tax experts, having an office manager with tax expertise is incredibly valuable. Bookkeepers ensure that a business makes the most economically viable and safe decisions to keep finances tight and under control.

Would you pay $33000 for 4 nights in a Coachella festival VIP yurt ….

Posted: Fri, 14 Apr 2023 16:32:07 GMT [source]

Generally, candidates who pass a part of the examination can carry over a passing score up to two years from the date they passed that part of the examination. To provide candidates flexibility in testing because of the global pandemic, the two-year period is extended to three years. The IRS has such strict standards about earning an EA credential that everyone understands it means deep knowledge and a range of expertise. An EA is not limited to state or regional knowledge, either. Because it is regulated by The Department of Treasury, EA credentials are recognized and revered in every state. Momentum above 80%, use the reports and focus on the areas where you answered questions incorrectly.

Please help us protect Glassdoor by verifying that you’re a real person. If you continue to see this message, please emailto let us know you’re having trouble. Find a place you want to live or a firm you want to work for and then use the table below to inform your salary expectations.

And understand commission schedules and agent contracts.https://1investing.in/ data as provided for project work. Assess and analyze data as requested.Review documents in work distributor for research.. Our Aged care and Rehabilitation area is currently offering the below exciting opportunities for enthusiastic and experienced Enrolled Nurses. Compare salaries for individual cities or states with the national average. I am the author of How to Pass The CPA Exam and the publisher of this and several accounting professional exam prep sites. Try another search query or take our salary survey to get a personalized salary report for your job title.

Location-based strategies pay workers higher or lower salaries for comparable work. Employees living in areas with higher living costs earn more, while individuals in more affordable areas earn less. These statistics indicate unusually high levels of variance in a tax preparer’s earning power. A $50,000 salary is typical for a mid-level enrolled agent with five to ten years of experience. Description of benefits and details at hrblock.com/guarantees. If you’re a CPA or an attorney, you can represent taxpayers in front of the IRS.

10 years after the Boston Marathon bombing, how has public safety ….

Posted: Fri, 14 Apr 2023 15:21:05 GMT [source]

Tax planning and audit support experience preferred. Bachelor’s degree in accounting or related field a plus. If the expenses are higher in a particular city, then the wage level will be higher as well to afford the people can opportunity to live there. This is why you’re always going to make more money in New York City for example, than in a small town. According to our latest salary estimation on March 28, 2023. The average salary of Enrolled Agent is $52,255, and the average salary of Accountant Enrolled Agent is $0.

An EA license makes you the most credible and committed tax professional. As an enrolled agent, you’ll likely compete directly with CPAs . You might also compete with other accountants and bookkeepers.

As an enrolled agent, you will gain the stamp of approval from the IRS. You will be seen as a real tax expert, which means clients will trust you. You will be recognized as a tax expert in all 50 states.

To statement of comprehensive incomern the EA certification, you only need to pass all three sections. Candidates need not worry about any specific entrance exam or work experience to enroll in the course. However, the candidate must possess a bachelor’s degree and have some basic knowledge of accounting and taxation. You must apply for enrollment within one year of the date you passed the third examination part. If you are wearing eyeglasses you will be required to remove them for visual inspection to ensure they don’t contain a recording device.

Without completing basic and minimum or even not having basic EA certification you may lose basic tax representation rights for clients whose returns you are preparing. Enrolled agents can represent, advise, and prepare tax returns for individuals, corporations, and trusts. Enrolled agents are needed in small and large public accounting firms, corporate accounting departments, law firms, investment, revenue firms, in private practice and banks. If you would like to work for the IRS, you’ll find job openings for those with all levels of experience. It should be noted that the IRS looks at education but will also take experience, licensure and credentials into account when evaluating new candidates.

As part of an EA’s job responsibilities, he or she often develops a strategy for handling matters with the IRS. In this capacity, enrolled agents work to reach satisfactory agreements regarding plans, payments, estimations, and settlements. Due to the fact that this type of work can be quite complex, the job of an EA is often in high demand. As of October 2021, the Bureau of Labor Statistics recorded the national median salary for CPAs in the U.S. as $73,560. Jobs paying $58,500 or less are in the 25th percentile range, while jobs paying more than $83,000 are in 75th percentile.

In the eyes of their clients, EAs are incredibly valuable because they need help understanding the complexities of taxes and how they affect their business or their individual earnings. Becoming an enrolled agent is an excellent way to explore job opportunities and business prospects that may not otherwise be open. EAs specialize in tax issues of all kinds ranging from businesses to individuals. An EA license makes tax accountants highly desirable when it comes to jobs at a tax firm, a government entity, or for a CPA in the private sector. With an EA on their resume, it’s easy for someone to stand out among other job applicants.

Terms and conditions apply; seeAccurate Calculations Guaranteefor details. When you work with a tax pro at H&R Block, you can trust you have a professional in your court, dedicated to the highest standards of tax expertise and personal service. Whether you connect with a CPA or EA in one of our offices or through virtual tax preparation, you’ve got a tax expert focused on getting you your maximum refund.Disclaimer number 84 . Along with the costs of becoming an enrolled agent, you will have ongoing costs. Since you will need continuing education courses each year, it’s necessary to pay the fee for 16 or more hours per year.